We're delivering a synergy between technology and investment services to help power your wealth management business to enable scale in personalized portfolio management.

• Curate real-time insights from in-house bank CIOs and external asset managers.

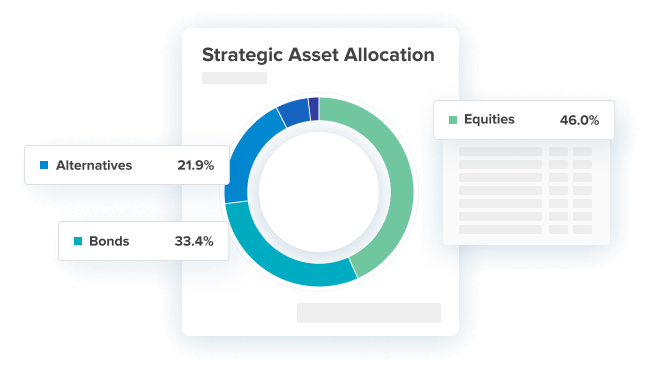

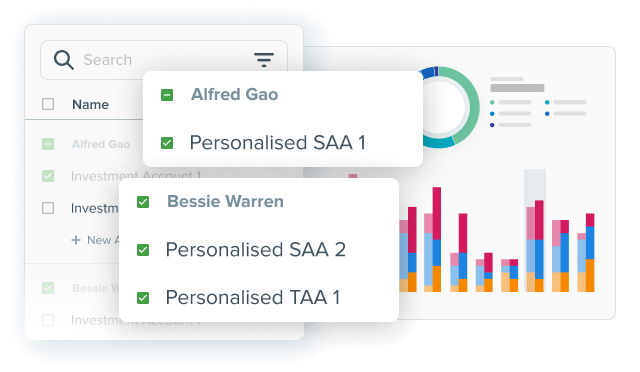

• Incorporate and monitor your SAA and TAA strategies.

• Enable the generation of engagement opportunities for end-customers with market shifts.

• Align with SAA/TAA via optimized underlying assets.

• Offer personalized direct indexing (using A.I.) with separately managed accounts.

• Ensure portfolio is aligned with customer values, tax optimized and compliant.

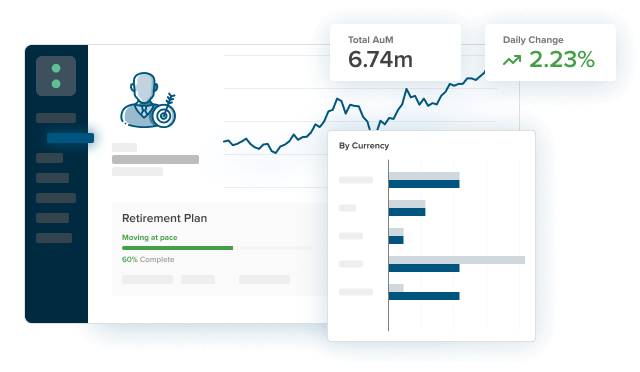

• Empower advisors and RMs with heightened understanding of their customers.

• Determine client's next-best-action powered with technology and A.I.

• Generate comprehensive investment proposals to build customer holistic wealth.

Retail & Private Banks

Through automated portfolio analytics, risk assessment, and real-time market insights, banks can provide customers with a holistic view of their wealth, allowing for more informed decision-making.

Privé enables banks to offer more efficient client-advisor interactions, fostering deeper relationships and trust.

Privé's technology harnesses the power of automation, data analytics, and artificial intelligence to streamline operations, enhance portfolio analytics, and deliver hyper-personalized financial solutions.

It's a seamless marriage of human insight and cutting-edge technology, propelling asset managers into the next era of financial excellence.

From risk assessment and portfolio optimization to conveying insurance products, our platform ensures insurance companies can better meet their clients' financial goals and risk management needs.

Privé enables streamlined operations, enhances customer experiences, and empowers insurers with personalized wealth management services, securing a brighter financial future for their policyholders.

Read our insightful articles, thought leadership reports, and company news.